The research found that jewelry consumers fall into two main categories: jewelry enthusiasts and the young and indifferent. Read more about the research on the webpage.

The research found that jewelry consumers fall into two main categories: jewelry enthusiasts and the young and indifferent. Read more about the research on the webpage.

Read more to find out about the other 21 companies included, as well as more information about Provoke Insights.

NYMRAD's State of the Market report for Q1 2019, conducted by Provoke Insights, was released.

Conducted quarterly, the report found that radio reaches 227 million Americans, 92% of the American population. The report contains details about New York's real estate and tourism markets.

The research concluded that 71% of millennials would invest in crypto if it were offered by traditional financial institutions, and half of all online investors were interested in a crypto allocation of their 401K pension plans. Read more on their site.

The research found many interesting trends, including that over two-fifths of millennials have less faith in the stock market than cryptocurrency, and that there is a demand for alternative cryptocurrency products.

In this subscriber only content to Quirk's customers, Fink discusses why even the most sales focused B2B companies need to make sure that they are monitoring their own branding and advertising initiatives.

The research found that education is the main barrier to investors who aren't willing to get involved in cryptocurrency, even among millennials.

The research discusses employment trends, key markets, summer information, and more.

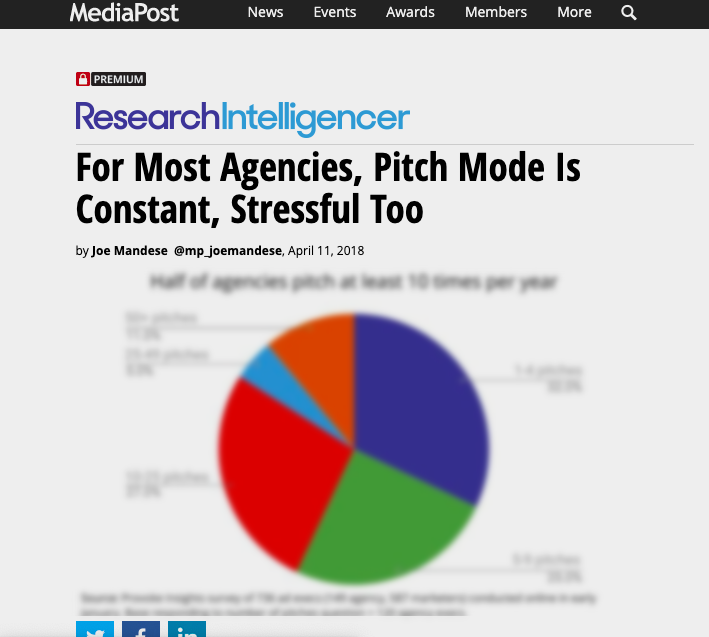

The research discusses advertising agencies, and is in a post limited to MediaPost subscribers. Read more at the link!

Provoke Insights put out a press release discussing the thought leadership research conducted concerning the pitch process and advertising agencies. Pitching remains a core part of agency life, but many teams feel the pressure. The ad pitch research surveys 736 advertising and marketing professionals to understand the impact on staff and what clients want from a pitch.

Key findings:

81 percent of advertising professionals take part in pitches. Eleven percent of agencies pitch every week of the year, and more than half pitch at least ten times annually. This process increases stress levels by 28 percent on average.

When asked what makes a pitch stand out, client-side marketers say creativity and a clear understanding of company goals matter most. Industry experience, good listening, cost efficiency, and solid research also help agencies win. Advertisers specifically name survey research as the best way to strengthen a pitch and show deeper insights.

Companies still rely on agencies for digital and social media, web design, and interactive campaigns, while traditional media like print ads, events, and commercials remain important parts of the plan. Larger companies spend far more than smaller companies, often by a factor of ten to fifty times.

Our ad pitch research also finds that working only on retainer is rare today. Many brands prefer a combination of retainer and project-based contracts, with 24 percent working project-by-project only.

These results confirm that research is not just an add-on. It gives agencies a stronger story, reduces risk for clients, and makes pitches more compelling and successful. Want to see our topical research? It can help with specific ad pitches. Check out our latest trends data here.

The article write up includes information on content marketing, ad agencies innovative usage of new technologies, how marketers follow agencies, and employees disgruntled with their colleagues.

AdWeek wrote an article an created an infographic based on research conducted by Provoke Insights.

The B2B research discusses the features/attribuets that a marketer is looking for in an advertising agency.

This blog shares highlights from Radio Ink’s recent coverage of the New York Market Radio Association’s Q4 2017 market report, which Provoke Insights writes each quarter. This quarter’s NYC radio research focuses on how the city’s booming financial sector fuels radio ad spending.

New York City’s economy continues to outperform expectations. Job growth reaches 1.8 percent, higher than the state average of 1.4 percent and the national average of 1.7 percent. The unemployment rate drops to 4.7 percent, down 0.3 percent from the same time last year.

This economic strength directly supports more local advertising. Our NYC radio research shows the financial services industry spends about 11 million dollars on New York radio in 2017. Top names like Wells Fargo, Bank of America, Citibank, Investors Bank & Trust, and Bethpage Federal Credit Union each double their spending to over 3.3 million dollars. Together, these institutions represent one-third of total financial category radio spending in the market.

Insurance companies also play a major role in the local radio scene. They spend over 11 million dollars on New York radio ads, with auto insurance leading the subcategories. Auto insurance remains highly competitive nationwide, with companies in this category spending more than 5 billion dollars on advertising overall.

The report also finds that 44.4 percent of New York companies with more than 500 employees include radio in their marketing mix. This figure is slightly higher than the national average. Key industries driving local radio ad dollars include automotive, retail, healthcare and pharmaceutical, and banking and financial services.

This NYC radio research confirms that radio remains a trusted and effective medium for reaching engaged local audiences, especially in a thriving market like New York City. Want to see Provoke Insights latest research? Check out here.

According to the study, 64 percent of consumers who purchase jewelry visit a jewelry store and speak to a jeweler during their research. This is 26 percent more than for other luxury products. Seeing jewelry in person and talking to an expert helps customers feel confident about their purchase. Consumers who speak to a jeweler are more likely to buy locally rather than online.

Gifting drives much of this behavior. Forty percent plan to give gold jewelry as a gift in the next year, while 32 percent choose sterling silver, colored gems, or pearls. Half of consumers say fine jewelry holds sentimental value and celebrates special moments. Forty-three percent have purchased or received jewelry as a gift in the past year, and over one-third plan to buy jewelry soon.

Retailers face competition from online sellers, but the in-store experience remains strong. Thirty-nine percent of jewelers say e-commerce is their top challenge, yet only 34 percent have an online store. Instead, jewelers focus on highly trained staff and excellent service to attract shoppers. Many consumers still appreciate the ability to see, touch, and ask questions before buying a valuable piece.

This fine jewelry research shows that even in a digital age, trust and personal service set local jewelers apart. Fine jewelry buyers continue to rely on expert guidance and the emotional connection that comes with shopping in person.

Provoke Insights supports Jewelers of America by delivering the data that helps retailers understand consumer trends and strengthen customer relationships.

Want to see our latest trends research on the affluent consumer? Check it out here.

The survey research supplied multiple takeaways, including that there is potential for advertising outside of just the holiday season, and that seeing jewelry in-person is still vital to the purchasing process.