The last census that the US conducted cost the country $13 billion. It is no surprise that the census data is important.

So, what is the census?

The census is mandated to be carried out every 10 years by the US constitution. It counts all people – citizens and non-citizens. It is also mandatory to respond to the census so that the government will have an accurate count of the population. This serves as the backbone of fair political representation and it plays a role in many other areas of public life.

The information that is produced by the census is some of the most reliable data that exists because it is the only research study that encapsulates the entire population of the United States. As a result, companies including market research firms find this information vital. The statistics provide information such as gender, age, and household income. Also, it is possible to drill down the data by state, country, city, or even zip code.

Below are some examples of how market researchers use the extremely useful resource of census data:

Quotas

Market researchers use the census break down of the population to ensure that their sample is representative of the demographic make-up of the population that the study is targeting. In some cases, researchers use a sampling technique called weighting to help ensure accuracy.

Projections

When conducting survey research, often new segments or audiences are found. Using the census information, a researcher can calculate an estimation of the size of the population.

Where to Find the Census Information

The Census data is easily accessible to everyone. It is data that you have free access to, no matter who you are. The information is readily available here data.census.gov

The platform was recently updated and now includes several tools to analyze the data. Below outlines how to use the new website.

How To Use the New Census Database

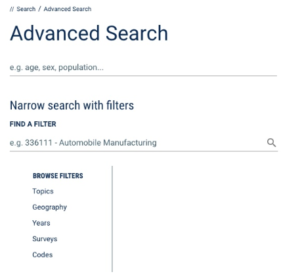

The new census database makes it easy to find what you’re looking for with a table of options to mix and match from. There are a couple of ways to start your search. For example, if you are looking for general demographics and all of the different census surveys, click on the “View Tables” option on the home page. This will come up with a table and an option to pick a particular survey to view. This is the simplest way to get the general information if that’s what you are looking for.

On the other hand, if you are looking to dig deeper into a particular category, use the advanced search, shown in the figure above. There is a range of filters for you to look at it, including years and geography. Within the geography, you can make your search as broad as the whole country, and as granular as a census tract, giving you many options.

Topics are within these filters, where you can choose between different categories, including the economy, education, employment, living arrangements, health, housing, and more. Once you choose a topic and geography, the platform will direct you to a corresponding table for what you picked.

The table feature is very easy to use. However, there are still a few glitches with downloading tables when you want to. Hopefully, because this is a new system, it will be fixed in the near future!

Sign up for our newsletters here!

Follow our social media accounts:

Twitter: https://twitter.com/provokeinsights