As mentioned in previous blogs and webinars, market research is best when its results are applicable. Research needs to have real-world significance for it to be worth conducting. Particularly when it comes to allocating marketing dollars, research can be a great tool to determine your target audience. Thankfully, there are research methods like segmentation that do just that!

Segmentation research is a way to better understand your prospects, current customers, as well as competitors’ target audiences. It provides a method to map out brand position and develop a deeper understanding of segments. Segmentation can also help drive customer growth by determining the right level of marketing investment required based upon the segment’s growth potential.

How does Segmentation work?

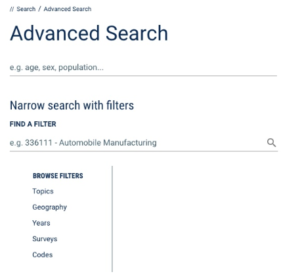

There are a few ways to conduct a segmentation study. First, you need to have a dataset. Usually, quantitative surveys are the best way to gather an adequate audience to segment potential markets. Additionally, you could segment a company database, although that will be a segmentation of your current/past customers vs. including your prospects.

Once you have your dataset, the first step is to uncover themes using an advanced analytics technique called factor analysis. To generate the segments, you then conduct a cluster analysis in order to create cohorts that are not only manageable but also sizeable (making them sufficient to warrant the investment). This statistical technique is used to separate groups by clusters of answers to find groups that have similar behavior. As a result, you can segment your dataset into customers who have different consumer behaviors, and understand who might be your ideal customer.

On top of the dataset you are using, you can supplement your primary research with secondary research. This can include additional research on personas with the behaviors you found, including where they live geographically, as well as detailed media habits. Thereby accompanying your primary research with real-world results to better understand the bigger picture, and have strong results.

The Value of Segmentation

The value of segmentation research is that it directly ties into the usability of the findings. We provide direction to bring the segmentation alive and off the page. The end game is to ensure that all segments are “actionable”, meaning your company can easily target these prospects and customers. For instance, once your personas are created, using their behaviors, you can create personas and assign them names and bring their behaviors to life.

As a result, you will have a group of personas into which you can separate your overall audience. Their purchasing and consumer behaviors will pair with their demographics to help you understand exactly who your company needs to be prioritizing and omitting in terms of audience.

You can create a predictive algorithm (typing tool) to help group prospects and customers into a distinct group. This way your marketing is better targeted to their needs.

In this case, you will be able to create a marketing strategy based on who you find to be your target audience, and who you find to be a disaffected audience. Likewise, you will find out who you should spend less time targeting. This is because your return on investment in terms of marketing dollars will be poor.

Conclusion

In conclusion, segmentation research is a great way to split your audience into different personas, leading to an actionable marketing strategy. In terms of market research methods, it’s a great way to combine both primary and secondary research methods. As a result, you will understand the consumer audience that your brand will draw.

If your company is interested in content marketing research, please reach out to [email protected], and we will be happy to schedule a call to discuss the research objectives with you.

In addition, check out Provoke Insights research services here.

Read more about segmentation on the Provoke Insights’ blog here:

Sign up for our newsletters here!

Follow our social media accounts:

Twitter: https://twitter.com/provokeinsights